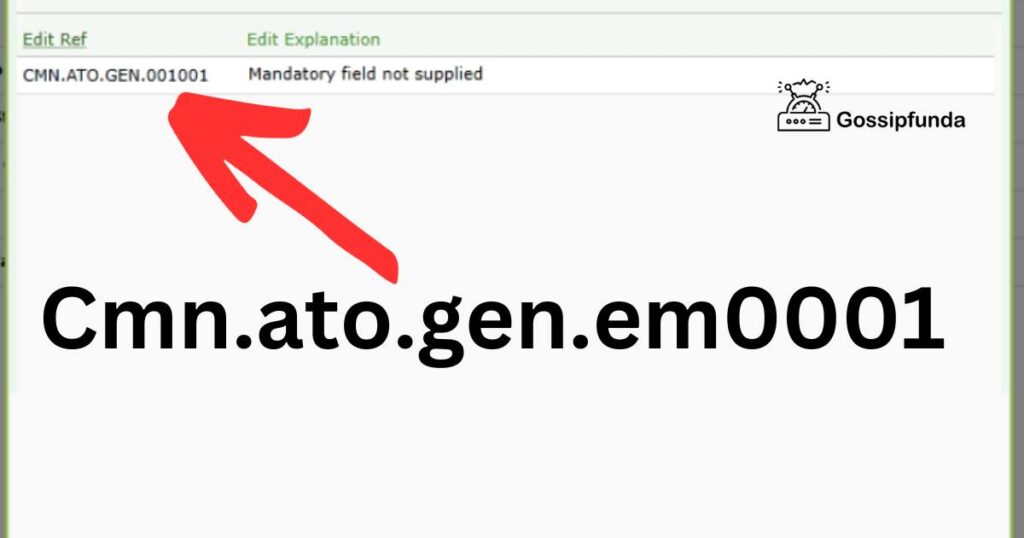

It’s a quiet day at the office, and you’re diligently attending to your financial paperwork. Suddenly, an unexpected error code, cmn.ato.gen.em0001, pops up on your screen. You’re baffled. Not to worry! This article delves deep into the reasons behind this error and provides a step-by-step guide to fixing it.

Reasons Behind the CMN.ATO.GEN.EM0001 Error

- ATO System Restrictions: Occasionally, the ATO system undergoes updates or maintenance. During these periods, certain functionalities might be temporarily suspended, leading to errors like cmn.ato.gen.em0001 when users attempt to make amendments or submissions.

- Incorrect Submission Details: If the information submitted to the ATO has discrepancies or inaccuracies, the system might flag these details, resulting in the aforementioned error. This could be anything from a mismatched ABN to an outdated TFN.

- Overlapping Amendment Requests: Submitting multiple amendment requests in a short time span can sometimes confuse the system. If the ATO perceives this as a redundant or duplicative request, it might trigger the error.

- Expired User Session: If there’s a prolonged period of inactivity during a session or if a session has expired while you’re making an amendment, it could lead to the error.

- Backend System Glitches: Like all digital platforms, the ATO system isn’t immune to occasional glitches or bugs. These unexpected issues can sporadically produce errors like cmn.ato.gen.em0001.

- Network Issues: Sometimes, the problem isn’t with the user or the ATO system but with the network. Fluctuating internet connections or downtime can disrupt communications with the ATO server, causing the error.

- Outdated Software or Browser: Using an outdated version of the ATO software or an incompatible web browser might not be in sync with the latest ATO system requirements, leading to potential errors.

Remember, understanding the root cause of an issue is the first step towards finding an effective solution.

How to Fix cmn.ato.gen.em0001?

Fix 1: Addressing ATO System Restrictions

When confronted with ATO System Restrictions, it’s essential to approach the situation with patience and clarity. These restrictions are typically temporary and put in place for system maintenance or updates. Here are detailed steps to address this issue:

- Check ATO Announcements: Before diving into any further troubleshooting, visit the official ATO website or the related portal. They often announce scheduled maintenance or updates, providing clarity on potential downtimes.

- Wait and Retry: If you’ve identified that the system is under maintenance or updating, it’s best to wait for the specified period. Once the maintenance window is over, try your amendment or submission again.

- Log Out and Re-login: Sometimes, a simple session refresh can bypass minor restrictions. Log out of the ATO portal, clear your browser’s cache and cookies, and then re-login. This can resolve potential session-related hiccups.

- Seek ATO Support: If you’re unsure about the nature of the restriction or if it persists post the announced timeframe, it’s wise to contact ATO support directly. They can provide insights into the specific restriction and advise on the next best steps.

- Document Your Attempt: It’s always a good practice to screenshot or document your error. This can be helpful when explaining your situation to ATO support or for your personal records.

- Stay Updated: Make it a habit to regularly check ATO notifications or announcements. Being proactive can help you anticipate and prepare for any upcoming system restrictions.

- Alternative Lodgment Methods: If the online system continues to present challenges, consider asking the ATO about alternative methods for your submission. This might include manual submission methods or using a different platform.

In essence, while ATO System Restrictions can be a temporary hindrance, they’re usually in place for the system’s betterment. A combination of patience, staying informed, and seeking direct support ensures you’re well-prepared to tackle this challenge.

Don’t miss: Yahoo fantasy football app not working

Fix 2: Resolving Incorrect Submission Details

An error stemming from Incorrect Submission Details can be a common culprit behind the cmn.ato.gen.em0001 error. When details don’t match ATO’s records, the system naturally flags these discrepancies. Here’s how you can tackle this:

- Double-Check Your Inputs: Before proceeding further, revisit the data you’ve entered. Look for obvious mistakes in Tax File Numbers (TFN), Australian Business Numbers (ABN), or other essential details.

- Update Personal Details: Ensure that all your personal and business details are up-to-date. If there have been recent changes, such as a change in address or business name, update these on the ATO portal before making a new submission.

- Review Previous Submissions: Compare your current submission with past successful ones. Identify any discrepancies or changes that could be triggering the error.

- Use Autofill Wisely: While browser autofill features are convenient, they can sometimes populate fields with outdated or incorrect information. It’s good practice to manually enter crucial details to avoid mistakes.

- Consult Your Records: Refer to your official documents or records when filling out forms. This ensures that the data entered matches what’s on your official documents.

- Seek ATO Clarification: If you’re uncertain about any detail or if you believe everything is correct but still face issues, contact the ATO support. They can cross-check their records and guide you accordingly.

- Regularly Update Your Profile: To prevent future discrepancies, regularly review and update your profile on the ATO portal. This proactive step ensures that all submissions align with your most current details.

By paying close attention to detail and ensuring that all provided information aligns with the ATO’s records, you’ll greatly reduce the chances of encountering submission-related errors.

Fix 3: Managing Overlapping Amendment Requests

Encountering the cmn.ato.gen.em0001 error might sometimes be due to Overlapping Amendment Requests. If the system perceives multiple, similar requests in quick succession, it can flag it as potential spam or a redundancy. Here’s a structured approach to handle this scenario:

- Review Recent Submissions: Go to your submission history on the ATO portal. Identify if there have been multiple attempts or similar amendments sent in a short time frame.

- Space Out Amendments: If you’ve identified that you’ve sent multiple requests, it’s advisable to space out your submissions. Giving a gap between submissions allows the system to process each request distinctly.

- Cancel Redundant Requests: In the event that you’ve inadvertently sent out similar or duplicate requests, navigate to the submission queue and cancel the redundant ones. This can prevent system confusion.

- Clear Browser Cache: Sometimes, browsers might resend requests due to cached data. Clearing your browser cache ensures that you don’t unintentionally send the same data again.

- Wait for Confirmation: Each submission or amendment typically results in a confirmation notification from the ATO. Ensure you’ve received this before considering another amendment or submission.

- Contact ATO Support: If you’re uncertain about the nature of your submissions or if the system still flags your requests, it’s essential to reach out to ATO support. They can provide clarity on what’s happening behind the scenes.

- Keep Detailed Logs: Always maintain a record of your submissions and their timestamps. This log can be invaluable if you need to discuss your submissions with ATO representatives.

By ensuring that each request is distinct and by avoiding sending redundant information to the ATO system, you can ensure smoother interactions and fewer error encounters.

Fix 4: Addressing Expired User Sessions

When working on long forms or detailed amendments, there’s a risk of Expired User Sessions leading to the cmn.ato.gen.em0001 error. An expired session can disrupt your workflow and might prevent successful submissions. Let’s dive into steps to circumvent this challenge:

- Regularly Save Your Progress: Many online portals have an autosave feature, but it’s always a best practice to manually save your work periodically to prevent data loss.

- Stay Active: If you foresee a period of inactivity on your end, it’s advisable to log out and then re-login when you’re ready to continue. This ensures your session remains active and valid.

- Refresh Your Session: If you’ve been logged in for an extended period, consider logging out and then logging back in to refresh your session. This can often prevent unforeseen session timeouts.

- Avoid Multiple Tabs: Working on the ATO portal across multiple browser tabs can sometimes confuse the session management system. Stick to a single tab for a seamless experience.

- Clear Cookies and Cache: Stored cookies might sometimes interfere with a fresh session. Regularly clear your browser’s cache and cookies, especially if you encounter frequent session-related issues.

- Update Your Browser: An outdated browser might not handle sessions as efficiently as its newer counterparts. Ensure you’re using a recent version of your preferred browser.

- Seek Technical Support: If session-related errors persist, it might be worth reaching out to ATO’s technical support. They could provide specific solutions tailored to your situation or even report it as a system-wide issue if others face similar challenges.

Remember, online portals are designed for user convenience, but they do have operational thresholds. By being proactive in managing your sessions, you can ensure a smooth and uninterrupted experience on the ATO portal.

Fix 5: Navigating Backend System Glitches

All online platforms, including the ATO system, can experience Backend System Glitches. These are unpredictable hiccups that might lead to the cmn.ato.gen.em0001 error. Let’s explore steps to address these glitches:

- Restart Your Application: If you’re using a specific ATO application or software, try closing and reopening it. A simple restart can often bypass minor system glitches.

- Update Your Software: If you’re using third-party software to interact with the ATO, ensure it’s the latest version. Outdated software might not communicate well with the ATO’s updated backend.

- Wait and Re-attempt: Sometimes, the best solution to a glitch is patience. Wait for a few minutes to an hour and then try your submission again.

- Check System Status: Some platforms provide a status page that displays any ongoing system issues. It’s worth checking if ATO has such a page to keep informed.

- Contact ATO Support: If you suspect a system glitch, notify the ATO support team. Your feedback can help them identify and rectify issues faster.

- Maintain Error Logs: Should you encounter glitches frequently, keep a record. This can help in discussions with support teams or even for your personal troubleshooting.

Fix 6: Overcoming Network Issues

Network Issues can disrupt your connection to the ATO server, possibly causing errors. Here’s a step-by-step guide to ensure a stable connection:

- Check Your Internet Connection: Ensure you have a stable and strong internet connection. If the network is unstable, it can disrupt data transmission.

- Use a Wired Connection: If possible, use a wired Ethernet connection. It’s generally more stable than a wireless connection.

- Reset Your Router/Modem: If you face consistent connection issues, try resetting your router or modem. This can often refresh your connection.

- Avoid Peak Times: Sometimes, network congestion during peak usage hours can slow down connections. If possible, try accessing the ATO portal during off-peak hours.

- Contact Your ISP: If you suspect the issue is on your Internet Service Provider’s end, contact them for assistance or updates on potential outages.

Fix 7: Ensuring Compatibility with Updated Software or Browsers

Using Outdated Software or Browsers can lead to compatibility issues. Here’s how to ensure you’re in sync with ATO’s requirements:

- Update Your Browser: Regularly update your web browser to its latest version. New updates often come with improved security and compatibility features.

- Use Supported Browsers: Always refer to the ATO’s recommended list of web browsers. Some platforms may not be fully compatible, leading to errors.

- Disable Extensions/Add-ons: Some browser extensions can interfere with the ATO portal’s functionality. Consider disabling them and then try your submission again.

- Use Default Settings: If you’ve tweaked advanced settings in your browser, consider resetting to default. Custom configurations might sometimes conflict with portal requirements.

- Check for Software Updates: If you use specific software to interact with the ATO, keep it updated. Manufacturers often release patches to address compatibility issues.

By keeping software and browsers updated, you align with the evolving digital landscape and ensure a smoother interaction with online portals like the ATO’s.

Fix 8: Handling Data Input Oversights

One overlooked aspect that can lead to the cmn.ato.gen.em0001 error is Data Input Oversights. These are small mistakes or omissions in the data you provide, which the system might not recognize or accept. Addressing this issue requires a meticulous review and understanding of the data being submitted. Here’s a methodical approach to troubleshoot this:

- Field-by-Field Verification: Go through each input field systematically. Ensure that every detail, no matter how trivial, is entered accurately.

- Check Data Formats: The ATO system may require specific data formats, especially for dates, monetary values, or unique identifiers. Ensure your input aligns with these formats.

- Avoid Special Characters: Some fields might not accept special characters like &, %, $, etc. Review your data to ensure none of these unwanted characters are included.

- Mandatory Fields: Overlooking mandatory fields can trigger errors. Ensure that all required fields, often marked with an asterisk (*), are filled out.

- Cross-Reference with Official Documents: Use official documents as a reference when filling out forms. This minimizes the risk of human error.

- Limit Text Length: Some fields might have a character limit. Ensure your input doesn’t exceed these limits.

- Seek Peer Review: Sometimes, a fresh pair of eyes can spot mistakes that you might overlook. Consider having a colleague or another trusted individual review your inputs.

- Refer to ATO Guidelines: The ATO often provides guidelines or manuals for submissions. These can offer insights into common data input issues and their resolutions.

- Contact ATO Support: If after rigorous checks you’re still facing issues, it’s time to reach out to ATO support. They can provide specific feedback on your submission and highlight where the problem might lie.

Addressing data input oversights requires patience and a keen eye for detail. By ensuring every piece of data is accurate and in the right format, you can substantially reduce the chances of encountering errors during your interactions with the ATO system.

Conclusion

The cmn.ato.gen.em0001 error might seem daunting at first, but with the right approach, it’s manageable. Always consider seeking guidance from the ATO directly or from professionals familiar with the ATO system. With patience and diligence, such hurdles are easily surmountable, ensuring smooth financial operations for your business. Remember, the key lies in understanding the problem and methodically addressing it. Safe financial sailing ahead!

FAQs

It’s an error code from the ATO, indicating a submission issue.

Double-check your inputs. Use official documents as a reference.

Possibly. Ensure a stable connection when interacting with the ATO portal.

Yes. Update your software and browser to ensure compatibility.

Prachi Mishra is a talented Digital Marketer and Technical Content Writer with a passion for creating impactful content and optimizing it for online platforms. With a strong background in marketing and a deep understanding of SEO and digital marketing strategies, Prachi has helped several businesses increase their online visibility and drive more traffic to their websites.

As a technical content writer, Prachi has extensive experience in creating engaging and informative content for a range of industries, including technology, finance, healthcare, and more. Her ability to simplify complex concepts and present them in a clear and concise manner has made her a valuable asset to her clients.

Prachi is a self-motivated and goal-oriented professional who is committed to delivering high-quality work that exceeds her clients’ expectations. She has a keen eye for detail and is always willing to go the extra mile to ensure that her work is accurate, informative, and engaging.