In today’s fast-paced digital era, managing finances has never been easier, thanks to online banking solutions like Zelle. Offered by numerous US banks, Zelle enables users to send and receive money instantly, fostering seamless and contactless transactions. However, even with its popularity, users occasionally encounter issues that hinder their experience. If you’re facing problems with your US Bank Zelle service, you’re not alone. This comprehensive guide delves into the most common challenges and provides updated solutions to ensure your Zelle transactions run smoothly in 2024.

Understanding the Current Challenges with US Bank Zelle

As online banking evolves, so do the complexities associated with it. US Bank Zelle remains a preferred choice for many, but recent updates and changes in user behavior have introduced new challenges. From app compatibility issues to enhanced security measures, understanding these dynamics is crucial for troubleshooting effectively. Moreover, the rise in cyber threats has prompted banks to implement stricter protocols, which, while enhancing security, can sometimes lead to unexpected hurdles for users. Staying informed about these changes ensures you can navigate and resolve any issues promptly.

Common Causes of Zelle Not Working in 2024

Several factors can disrupt the seamless operation of Zelle. Identifying the root cause is the first step toward an effective solution. Here are the most prevalent issues users are encountering this year:

Obsolete Zelle App Version

Using an outdated version of the Zelle app can lead to compatibility issues and reduced functionality. Regular updates are essential to benefit from the latest features and security enhancements.

Unstable Internet Connection

Zelle relies heavily on a stable internet connection. Weak or intermittent connectivity can prevent the app from communicating effectively with bank servers, causing delays or transaction failures.

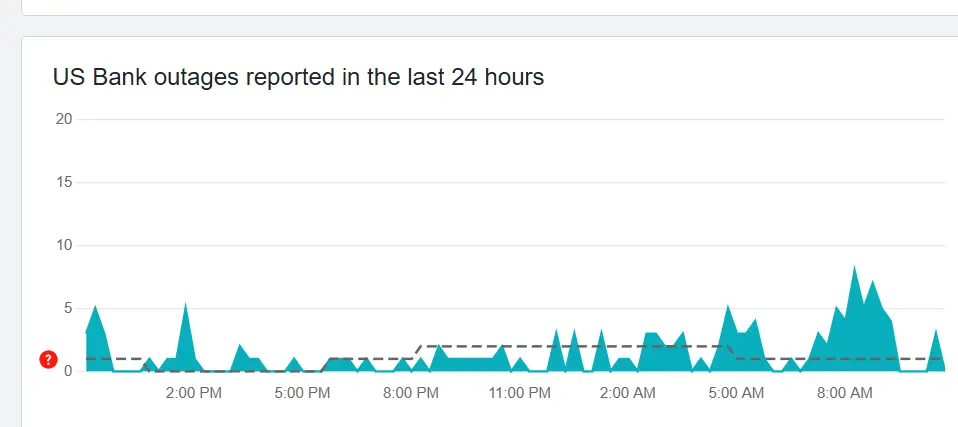

US Bank Server Maintenance or Outages

Occasionally, US Bank conducts scheduled maintenance or experiences unexpected outages. During these periods, Zelle services might be temporarily unavailable, affecting your ability to send or receive money.

Incorrect or Incomplete User Information

Accurate recipient information is vital for successful transactions. Mistakes in email addresses or phone numbers can lead to funds being sent to the wrong individual or transaction errors.

Security or Account Restrictions

Enhanced security measures, while necessary, can sometimes restrict account activities. Temporary holds or transaction limits might be imposed to protect your account, inadvertently affecting your Zelle usage.

Incompatible Device or Operating System

Zelle requires certain device specifications and operating system versions. Older devices or outdated OS versions may not support the latest Zelle functionalities, leading to performance issues.

Insufficient Account Funds

Ensuring your account has adequate funds is fundamental. Low balances can prevent successful transactions, resulting in declined transfers or delays.

Interference from Third-Party Apps

Certain antivirus or security applications can interfere with Zelle’s operations. These apps might block necessary permissions or disrupt the app’s communication with bank servers.

Step-by-Step Guide to Fixing Zelle Issues

Encountering issues with Zelle can be frustrating, but with a systematic approach, most problems can be resolved efficiently. Follow these steps to troubleshoot and fix common Zelle issues:

1. Update the Zelle Application

Ensuring you have the latest version of the Zelle app is crucial. To update:

- Open your device’s app store (Google Play Store for Android or Apple App Store for iOS).

- Search for “Zelle.”

- If an update is available, tap “Update.”

- Restart the app to apply the changes.

Regular updates not only provide new features but also fix known bugs that might be causing issues.

2. Verify Your Internet Connection

A stable internet connection is essential for Zelle to function correctly. To check:

- Switch between Wi-Fi and mobile data to see if the issue persists.

- Restart your router if you’re using Wi-Fi.

- Move closer to your router to improve signal strength.

If connectivity issues continue, consider contacting your internet service provider.

3. Check US Bank Zelle Service Status

Before troubleshooting further, verify if the problem is on US Bank’s end:

- Visit the US Bank Service Status on downdetector.

- Look for any announcements regarding Zelle outages or maintenance.

- If an outage is reported, wait until services are restored.

Staying informed about server status can save you time and frustration.

4. Double-Check Recipient Information

Accurate recipient details are paramount. To ensure correctness:

- Review the email address or phone number entered.

- Confirm with the recipient that their information is up-to-date.

- Avoid common typos or formatting errors.

Accurate information minimizes the risk of sending funds to the wrong person.

5. Contact US Bank Customer Support

If issues persist, reaching out to customer support can provide personalized assistance:

- Call US Bank’s support line or use their online chat feature.

- Explain the issue in detail, providing any error messages received.

- Follow the instructions provided by the support representative.

Customer support can offer insights into specific account-related problems.

6. Review Account and Security Settings

Enhanced security can sometimes restrict transactions. To review:

- Log in to your US Bank account online.

- Navigate to the security settings section.

- Check for any transaction limits or security holds.

- Adjust settings if necessary or contact support for assistance.

Understanding your account’s security settings ensures you’re aware of any restrictions that might affect Zelle.

7. Ensure Device Compatibility

Zelle requires certain device specifications to operate smoothly. To verify:

- Check the Zelle app’s system requirements.

- Update your device’s operating system if it’s outdated.

- Consider upgrading your device if it’s too old to support the latest app version.

Compatible devices ensure optimal app performance.

8. Confirm Sufficient Funds in Your Account

Before initiating a transaction:

- Check your account balance to ensure it covers the transfer amount.

- Transfer funds into your account if necessary.

- Avoid exceeding your account’s daily transaction limits.

Maintaining adequate funds prevents transaction declines and delays.

9. Disable Conflicting Third-Party Applications

Third-party apps can sometimes interfere with Zelle. To identify and disable:

- Identify any recently installed antivirus or security apps.

- Temporarily disable these apps and attempt the Zelle transaction again.

- If successful, adjust the third-party app’s settings to allow Zelle’s operations.

Ensuring no interference from other applications can restore Zelle’s functionality.

Latest Trends and Solutions for Zelle Users in 2024

Staying updated with the latest trends ensures you leverage Zelle’s full potential. 2024 has seen several advancements and changes that enhance user experience:

- Enhanced Security Features: With the rise in cyber threats, Zelle has implemented biometric authentication and multi-factor verification to bolster security.

- Expanded Integration: Zelle is now more seamlessly integrated with a wider range of banking apps, allowing for unified financial management.

- Improved User Interface: The latest updates have introduced a more intuitive interface, making navigation and transactions smoother.

- Faster Transaction Speeds: Technological improvements have reduced transaction times, ensuring funds transfer almost instantly.

- Expanded Customer Support: Zelle has enhanced its support channels, including 24/7 live chat and AI-driven troubleshooting to assist users promptly.

Embracing these trends can significantly improve your Zelle experience.

Real-Life Examples and User Experiences

Understanding how others navigate Zelle issues can provide valuable insights:

- Sarah’s Story: After updating her device’s OS, Sarah found that her Zelle app was no longer functioning. By following the step-by-step guide, she realized the app needed an update. Post-update, her transactions proceeded without a hitch.

- John’s Experience: John faced transaction delays due to a temporary server outage at US Bank. By checking the service status page, he confirmed the issue was on the bank’s end and patiently waited until services were restored.

- Emily’s Challenge: Emily accidentally entered an incorrect phone number while sending money. By contacting customer support, she was able to retrieve her funds and resend them to the correct recipient.

These real-life scenarios highlight the importance of systematic troubleshooting and utilizing available resources effectively.

Risks and Considerations When Troubleshooting Zelle

While troubleshooting can resolve many issues, it’s essential to be aware of potential risks and considerations:

- Security Risks: Disabling security apps to troubleshoot can expose your device to vulnerabilities. Ensure you reactivate any security measures once the issue is resolved.

- Data Privacy: Sharing sensitive information with third-party apps or services can compromise your privacy. Always use trusted channels when seeking support.

- Potential Fees: Some solutions, like upgrading your device or increasing account limits, might incur additional costs. Assess the necessity before proceeding.

- Transaction Limits: Attempting to bypass transaction limits can lead to account restrictions or penalties. Always adhere to your bank’s guidelines.

Being mindful of these considerations ensures that troubleshooting remains safe and effective.

Conclusion: Ensuring Smooth Transactions with US Bank Zelle

Experiencing issues with US Bank Zelle can be frustrating, but with the right approach, most problems are easily resolvable. By updating the app, ensuring a stable internet connection, verifying recipient information, and leveraging customer support, you can overcome common challenges. Additionally, staying informed about the latest trends and updates in 2024 will enhance your overall Zelle experience. Remember, platforms like Gossipfunda offer valuable resources and guides to help you navigate the ever-evolving landscape of digital banking. With these strategies in place, you can enjoy seamless and secure transactions, making the most of what Zelle has to offer.

FAQs

Indeed, utilizing a VPN (Virtual Confidential Organization) can some of the time disrupt the legitimate working of Zelle. It is prescribed to handicap the VPN briefly while utilizing Zelle to stay away from any possible issues.

This mistake message can happen because of different reasons, for example, network availability issues or brief assistance interruptions. Hang tight for quite a while and attempt some other time. On the off chance that the issue continues, reach US Bank client service for additional help.

Indeed, having numerous Zelle accounts connected to a similar telephone number can prompt struggles and exchange disappointments. It is prescribed to involve interesting email locations or telephone numbers for each Zelle record to keep away from any confusions.

Divyansh Jaiswal is a B.Tech graduate in Computer Science with a keen interest in technology and its impact on society. As a technical content writer, he has several years of experience in creating engaging and informative content on various technology-related topics.

Divyansh’s passion for writing and technology led him to pursue a career in technical writing. He has written for various publications and companies, covering topics such as cybersecurity, software development, artificial intelligence, and cloud computing.

Apart from writing, Divyansh is also interested in exploring new technologies and keeping up with the latest trends in the tech industry. He is constantly learning and expanding his knowledge to provide his readers with accurate and up-to-date information.

With his expertise in both technology and writing, Divyansh aims to bridge the gap between complex technical concepts and the general public by creating easy-to-understand content that is both informative and enjoyable to read.