Loan EMI Calculator: Calculate Monthly Payments Instantly

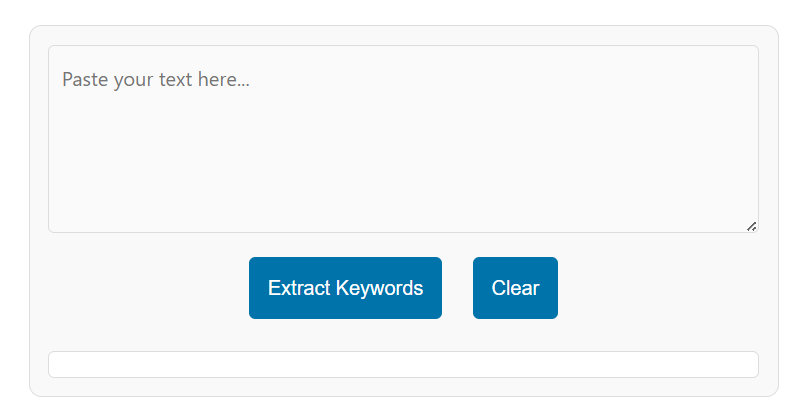

Loan EMI Calculator

Break-up of Total Payment

EMI Payment / Year

EMI Schedule

| Month # | Principal | Interest | EMI | Balance |

|---|

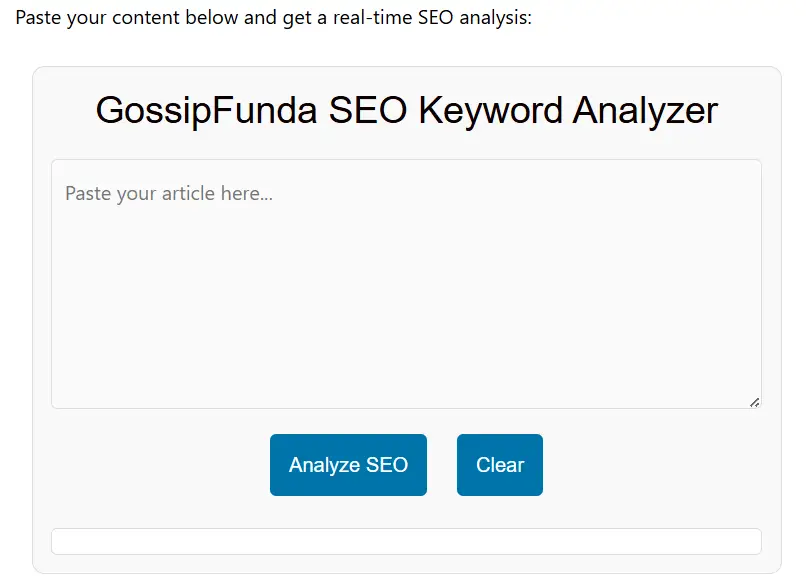

What is EMI?

EMI (Equated Monthly Installment) is the fixed amount you pay monthly to repay loans. It includes:

- Principal amount

- Interest charges

- Other fees (if applicable)

How to Use This EMI Calculator

- Loan Amount: Enter total loan (e.g., ₹10,00,000 for home loan)

- Interest Rate: Annual rate (e.g., 8.4%)

- Tenure: Choose years/months (e.g., 20 years)

- Click Calculate EMI

Example:

- ₹25 lakh loan at 9% interest for 15 years = ₹25,363/month

The EMI Formula Explained

We use the standard EMI formula:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1] - P = Loan Amount

- R = Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100)

- N = Tenure in Months

Key Features of Our Calculator

✅ Instant Results: No page refresh (AJAX-powered)

✅ Mobile-Friendly: Works perfectly on all devices

✅ Detailed Breakdown:

- Monthly EMI

- Total Interest Payable

- Total Payment (Principal + Interest)

✅ Free to Use: No registration required

5 Factors Affecting Your EMI

- Credit Score: Higher score = Lower interest rates

- Loan Tenure: Longer tenure = Smaller EMI (but higher total interest)

- Loan Type:

- Home Loan: 8.4%-14%

- Car Loan: 9%-15%

- Personal Loan: 10%-24%

- Down Payment: Larger down payment = Smaller loan amount

- Floating vs Fixed Rates

How to Reduce EMI Burden

- Prepay Loan: Reduce principal amount early

- Negotiate Rates: Compare 3-4 lenders

- Balance Transfer: Switch to lower-interest loans

- Increase Tenure: (Use cautiously – increases total interest)

Why Trust This Calculator?

- Accurate Formula: RBI-approved calculation method

- Secure: No data collection/storage

- Updated: Reflects latest interest rate trends

- Expert-Designed: Created by financial analysts

Common EMI Questions (FAQ)

Yes, EMIs remain fixed in most loans unless interest rates change (floating rate loans).

No – All term loans require EMI payments. Only credit cards allow minimum payments.

Yes – Section 80C (principal) and 24(b) (interest) for home loans.

3%-4% penalty fee + credit score damage. Contact lender immediately.

Pro Tips for Loan Borrowers

- Keep EMI ≤ 40% of monthly income

- Use our calculator to compare 3 scenarios before applying

- Check processing fees (1%-2% of loan amount)

Awill Guru is a technology enthusiast with degrees in VLSI Engineering (B.Tech, M.Tech) and Android Development. Their passion for education drives them to teach and share knowledge through their blog. He also hold qualifications in Sociology (M.A.) and Education (B.Ed), along with NIELIT O and A Level certifications.